The conversation around metal scrap in advanced manufacturing usually stops at recycling bins and scrap buyers. What often gets overlooked is the financial drag that unprocessed material creates inside an organization. Many OEMs feel pressure from rising metal prices, uncertain supply chains, and tighter sustainability expectations. Yet the scrap they produce every day also represents an underused asset with the potential to strengthen supply continuity and lower costs.

A circular feedstock strategy offers a path forward. It turns what used to be a liability into a controlled, traceable input that supports production needs. The challenge is that most teams do not see the full picture. Scrap costs are often hidden inside storage budgets, waste contracts, insurance line items, or lost time. With more OEMs shifting toward AM and hybrid production models, these costs will only grow unless companies rethink how they handle leftover materials.

The real cost of holding metal scrap

Scrap does not sit quietly in a corner. It consumes space, requires tracking, and carries real financial weight. The U.S. Environmental Protection Agency reported that industrial facilities spend between six and twelve percent of their total waste management budgets on storage, handling, and internal logistics before recycling or disposal takes place.

Market volatility adds another layer. Nickel prices have swung more than thirty percent in multiple quarters over the past three years. This is based on pricing data published by the London Metal Exchange, which tracks monthly and annual percentage swings in base metals. For example, nickel experienced a thirty five percent price decline in 2022 followed by double digit quarterly fluctuations through 2023 and 2024.

Alloys such as Inconel, Cobalt-Chrome, and high temperature superalloys used in turbine and energy markets follow the same trend, often with sharper movements due to specialty demand and limited global production.

Storage is not the only problem. Deloitte’s “Manufacturing Value Chain Waste Study” found that unmanaged industrial scrap increases total material waste by as much as twenty percent. The primary drivers are misclassification, contamination, and lack of controlled removal workflows.

When scrap mixes or oxidizes, it loses value, becomes harder to reclaim, and in many cases cannot be reintroduced into a controlled materials program.

Scrap as strategic feedstock

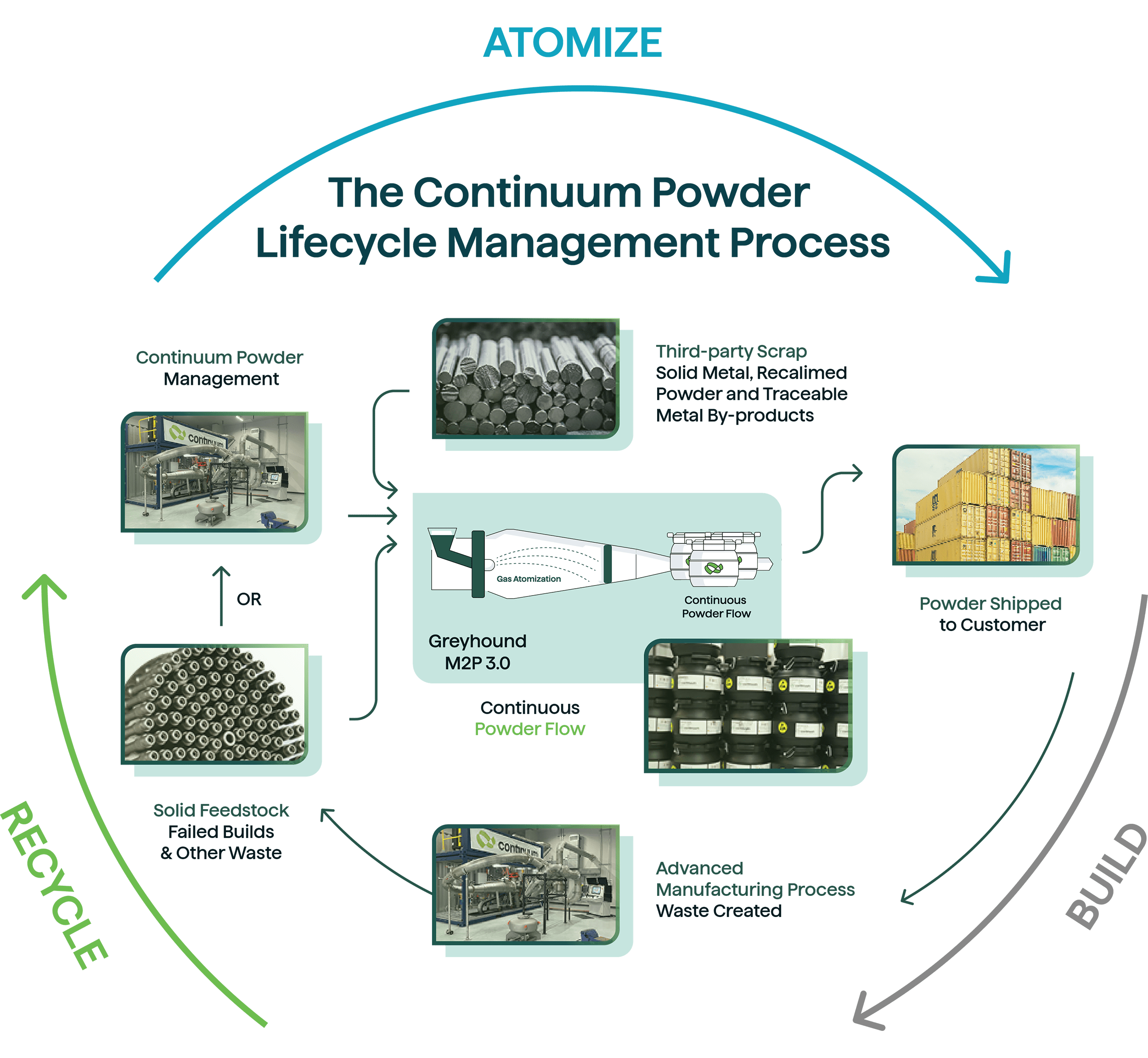

When reclaimed and refined properly, scrap can become a high-quality source of powder for additive manufacturing. This model creates a supply chain that is more predictable and less exposed to market swings. It also supports long-term sustainability goals.

Oregon State University’s life cycle assessment of Continuum’s process found that reclaimed metal powder production can reduce greenhouse gas emissions by up to 99.7 percent compared to traditional virgin powder sourcing. The study evaluated primary energy demand, carbon intensity per kilogram of powder, and scrap diversion impact.

A circular feedstock strategy gives OEMs more control over chemistry, sourcing, and long-term cost planning. Instead of selling scrap at a discount, companies can convert it into high-performance powder aligned with their production needs. This approach reduces dependence on global metal markets and shortens the path from raw material to final part.

What this shift means for 2026 and beyond

Manufacturers are entering a period where agility matters as much as throughput. AM is expanding in aerospace, energy, defense, and industrial markets. More teams are preparing to move from prototyping to production. Powder needs will rise and material flexibility will become an important advantage.

Circular feedstock strategies will help OEMs respond faster. They also strengthen resilience in the face of geopolitical pressure, supply chain inconsistencies, and tighter sustainability requirements. As companies evaluate alloy availability for binder jetting, HIP to print, and hybrid workflows, they will begin to treat scrap with new attention.

At Continuum Powders, we work with partners to convert high-quality scrap into powder that meets or exceeds the performance expectations of virgin material. The result is powder that supports demanding applications, delivers cost predictability, and helps teams take steps toward a more circular manufacturing model.

If 2025 was about proving the value of circularity at production scale, 2026 will be about helping more OEMs adopt it. Scrap is no longer just a byproduct. It is an opportunity waiting to be put to work.